| H O M E | COMMODITY STOCK RATING | niftysamraatAPP | Signals OPTION MAGIC | MUTUAL FUND V I D E O |

| HOME 1 | ||||

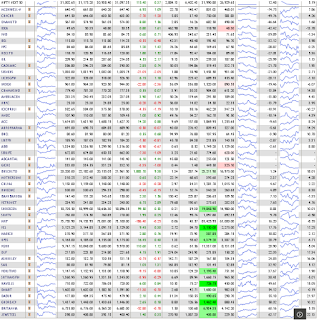

| Charts | P&F CHART | |||

| FUTURE OPTION |

V I D E O

HINDI CHART technical analysis GANN ELLIOT fibonacci ASTROLOGY DAY TRADING

share market MARATHI MUTUAL FUND HINDI STUDENT HOUSEWIFE

share market MT4 SOFTWARE share market AMIBROKER

TV EXPERT warren buffett TRADER excel APP